Renegade Launches Public Testnet

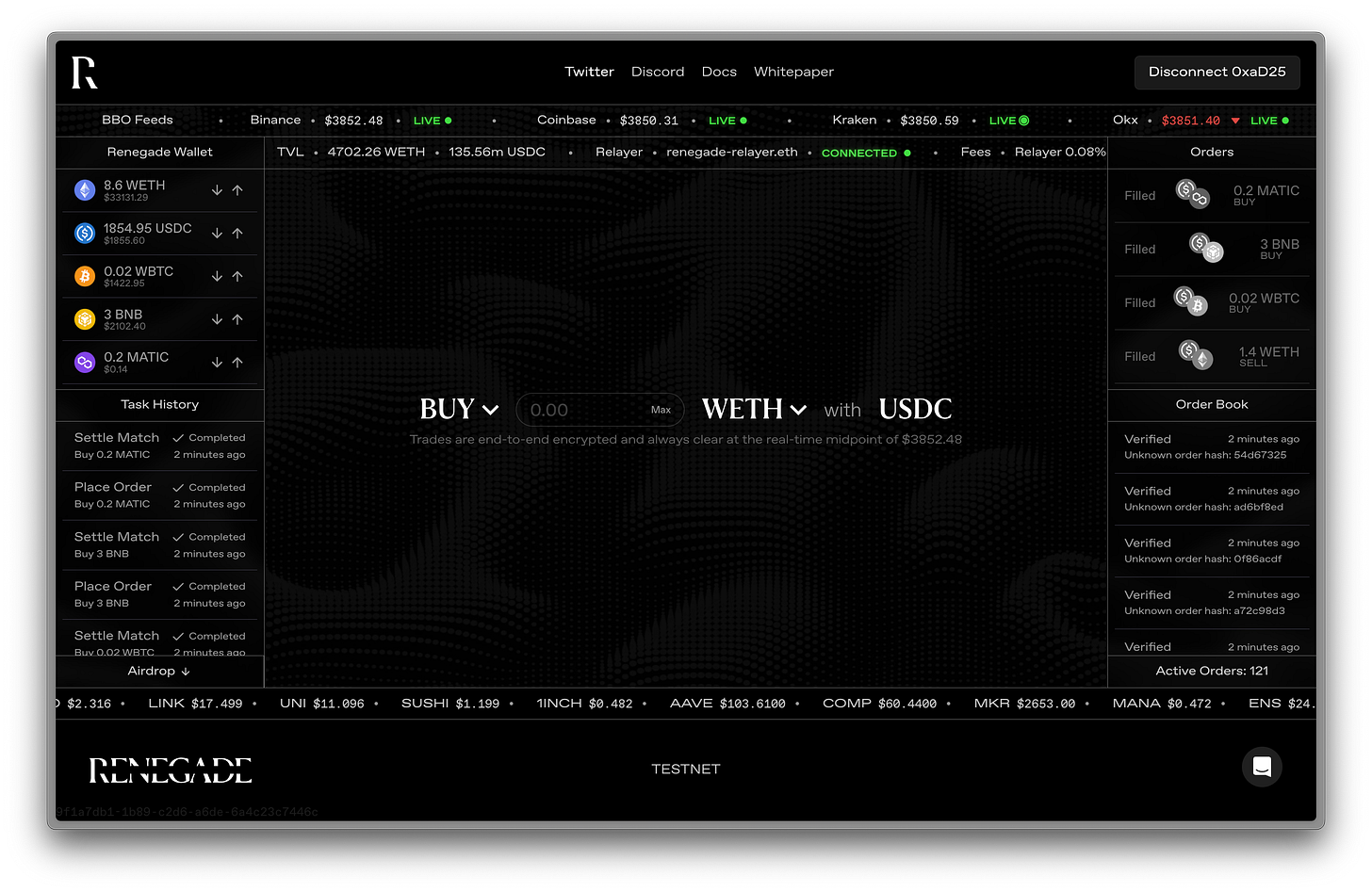

We've launched a production testnet environment for Renegade, the on-chain dark pool.

We’re excited to unveil Renegade’s testnet to the public! Try it out at trade.renegade.fi — all you need is a crypto wallet to get started.

What is Renegade, again?

Renegade is building an “on-chain dark pool”, a new type of decentralized exchange.

Dark pools are new to crypto, but they’re very popular in traditional equities trading. A dark pool (also called a “crossing network”) enables large, institutional traders to buy or sell large quantities of a stock without informing the wider market of the position that they’re accumulating.

Why keep trading private? In short, to get a better price — if the wider market was alerted of a large whale accumulating a position, the price would immediately jump in response, giving the whale a worse price on the rest of their trade.

Much like dark pools in equities, Renegade brings private trading to DeFi. As a “zkDEX”, Renegade enables completely confidential trading, all while being fully decentralized.

Why use Renegade?

In short, Renegade has two nice properties that make it a fantastic option to trade ERC-20s in size:

Optimal pricing — whenever you make a trade on Renegade, you’re guaranteed to get the midpoint of the Binance bid-ask spread. Since Binance is the most liquid exchange, it tends to lead in price discovery. So, by trading at the Binance midpoint, you’re getting the best price available, globally.

Optimal privacy — even though Renegade is fully decentralized, it keeps your order information completely confidential. No third-parties (including the Arbitrum sequencer or any Ethereum L1 block producer) can learn any details whatsoever about users’ orders, either before they fill or after the match has occurred.

Because of these pricing and privacy properties, Renegade solves a lot of problems in current DEX design:

Zero MEV — since trades in Renegade settle in zero-knowledge, there is no incentive for block producers to reorder or front-run Renegade transactions.

Guaranteed best execution — whenever a trade happens in Renegade, it will clear at the real-time midpoint of the Binance bid-ask spread. This is the best price available globally.

Pre-trade confidentiality — matching an order is done via a multi-party computation, so your order information is never leaked to any third-party whatsoever.

Post-trade confidentiality — settlement of trades is done in zero-knowledge, preventing third-parties from tracking your wallet holdings or copying your positions.

Renegade is true institutional-quality liquidity, made permissionless.

What’s the state of the testnet?

The current Renegade testnet is quite faithful to what mainnet latencies will look like. The system is running full zkSNARK proving and verification under the hood, with settlement onto Arbitrum Stylus.

Currently, Renegade has MPC matches disabled — all matches in the current testnet are “internal matches”, meaning they’re still in zero-knowledge, but not computed via a collaborative SNARK.

Nonetheless, most operations in Renegade (depositing tokens, placing an order, etc.) are accurate and faithful to mainnet latencies, and all operations will cost less than $1 in gas fees at mainnet.

MPC-based matching for self-run relayers will be launched in the coming weeks, as we make the network fully permissionless for mainnet.

What’s Next?

Over the coming months, we’ll be continuing to get the testnet ready for mainnet use with live funds. Currently, we expect to launch Renegade to mainnet in early August 2024, once Arbitrum Stylus goes live to mainnet.